Taxes — Taxation is actually a significant said to have opportunities stored inside the taxable account. Passively managed money actions such as ETFs often change quicker seem to than shared financing, causing smaller portfolio return and lower money gains. If your possibility of better taxation overall performance you like, an ETF is generally compatible. Exchange-exchanged money portray an installment-effective way to achieve contact with a general container out of ties which have a limited budget.

Investing tips having fun with ETFs

You.S. equities over the years underperform along side half a dozen-day Can get–Oct several months weighed against the fresh November–April several months. One other seasonal development ’s the desire out of silver to gain inside the September and you will October, thanks to solid request out of India prior to the marriage season and also the Diwali event of lighting. Such, imagine a trader could have been dedicated to the newest biotechnology industry as a result of the brand new iShares Biotechnology ETF (IBB). There are two main significant advantages of occasional spending first of all. As numerous monetary planners highly recommend, it will make eminent feel to invest on your own very first, which is everything reach by the preserving regularly. Below are the fresh seven greatest ETF exchange methods for novices, displayed inside the zero type of order.

The wider business publicity, sector-particular alternatives, and you will varied asset classes is allow advisers to produce tailored money possibilities and you can adapt to switching industry criteria. Hence, economic advisors is to very carefully look at the consumer’s risk endurance and investment expectations just before discussing expertise ETFs. Concurrently, advisers will be conduct comprehensive look to understand specialty ETFs that have good track facts, educated management communities, and you may clear money actions.

Exactly what are the top ETFs?

ETFs is actually classified to the collateral and you can non-equity (financial obligation, product, and you https://apex-nl.com/ can global) types to possess income tax motives, affecting its income tax ramifications. To shop for ETFs, complete KYC by submitting proof of name, target, and financial information. Then, open a trading and you will demat membership, as the ETFs must be stored in the demat mode and you will exchanged inside real-day during the business times. Buyers can buy ETFs thanks to SEBI-registered agents or individually through AMCs in the ‚Creation Unit‘ types playing with collection deposits otherwise dollars.

2Commission-free change out of Leading edge ETFs applies to trades set on the internet; really subscribers will pay a percentage to purchase otherwise promote Vanguard ETFs because of the cellular phone. Commission-100 percent free trading out of low-Vanguard ETFs can be applied in order to investments put online; extremely members will pay a commission to buy otherwise offer non-Vanguard ETFs from the cellular telephone. Innovative Brokerage reserves the legal right to replace the low-Vanguard ETFs included in these types of also provides any time. The ETFs is subject to government costs and you will costs; make reference to for each ETF’s prospectus to learn more. Understand the Cutting edge Brokerage Features fee and fee dates to possess full details. The market industry cost of an ETF is dependent upon the values of your own brings and bonds stored because of the ETF, and business likewise have and you may consult.

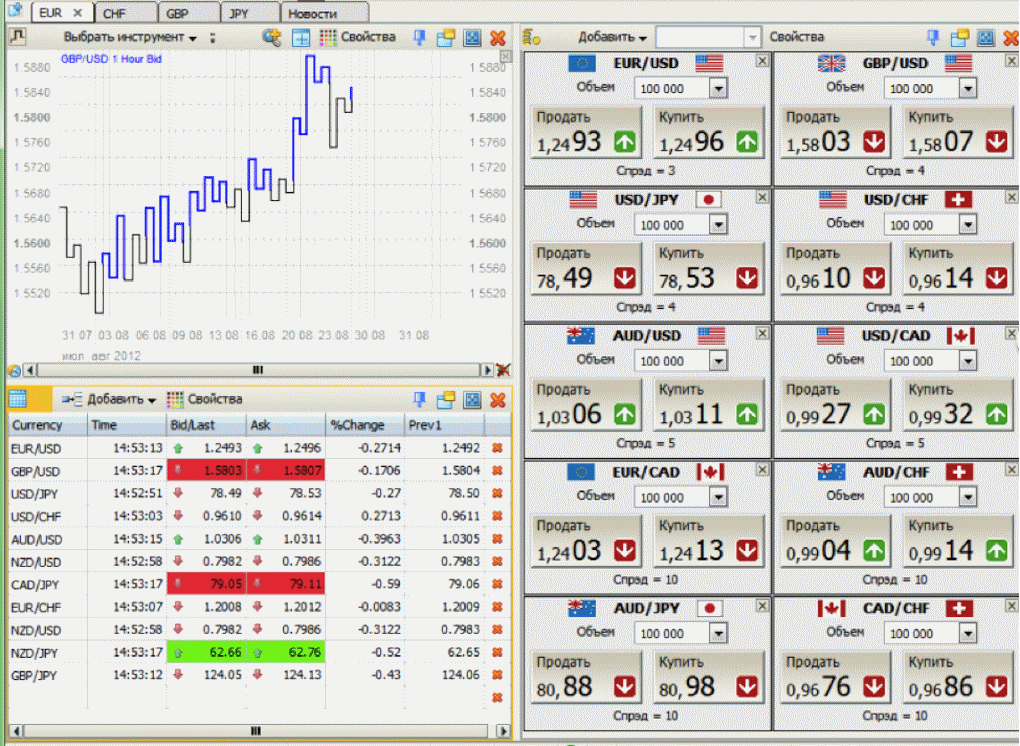

They may and hold bodily a property, along with from undeveloped home so you can high industrial functions. The fresh features of ETFs which make him or her suitable for swing trade try its diversification and you may rigorous bid-ask develops. Swing positions attempt to exploit significant price alterations in brings otherwise most other property such as currencies or commodities.

That it thing cannot constitute an offer or solicitation in any legislation where or perhaps to anybody so you can who it could be unauthorized otherwise illegal to do this. „Recommended“ content and extra information is generally available with PNC Opportunities affiliates, in addition to PNC Financial, PNC Riches Government and PNC Institutional Investment Administration. When you’ve got the collection in place, you’ll need sometimes display the profile’s results making one expected modifications. Of numerous, otherwise all, of your issues searched in this post are from our advertisements people whom compensate you when taking specific procedures for the our very own website otherwise simply click for taking a hobby on their website. The people don’t pay me to make sure favorable reviews of the products or services. Variation does not make sure money otherwise avoid loss in a declining business.

Actively addressed ETFs

They can pick or promote these finance in the industry costs on the a real-date basis.As the lowest money quantum is one unit, there isn’t any requirements regarding the minimum money number. Collateral ETFs is actually rates-energetic and offer transparency about their holdings. This type of financing end up being the a basket out of investment replaced to your replace. The newest supplier pools property such as stocks otherwise ties and will be offering shares to buyers. While you are traders very own an element of the finance, it don’t personally very own the underlying possessions.

He had is actually a reporter for the Wall structure Highway Record and you can business music producer for CNN.com within the Hong kong, in which he was based for almost two decades. Currency ETFs tune just one money otherwise a container from currencies and so are often supported by financial places inside a different money. Commodity ETFs invest in either bodily products, including absolute resources or metals, otherwise by-product contracts linked to the price of products. While you are a new comer to investing, it might nevertheless be a while confusing with what just an ETF are. ETFs allow you to spend money on a general portion of an excellent market, like the S&P five-hundred or even the Dow, or even in industry total. Control can also be magnify the brand new impact out of bad issuer, political, regulating, business, or monetary advancements on the a pals.

Each other help save you committed-consuming functions away from looking at businesses and you can choosing carries, even though mutual fund usually tend to be shorter tax-successful and now have higher government charge. If you are ETFs disclose holdings daily, one to generally goes month-to-month or every quarter that have shared financing. Purchases inside offers out of ETFs may result in broker earnings and you will may create income tax effects. All the regulated financing businesses are obliged in order to dispersed portfolio development so you can shareholders. There’s no assurance you to a working trade marketplace for offers of an enthusiastic ETF will develop or perhaps managed.

Specialization ETFs focus on market locations and certain financing themes, delivering concentrated attention to members having type of passions or objectives. Such ETFs will get focus on groups such technology, medical care, otherwise renewable power, otherwise they could tune larger layouts including socially in charge spending or ESG (ecological, social, and you can governance) issues. The newest ETF marketplace is huge and diverse, catering to several funding objectives.

Could you generate losses that have ETFs?

You can purchase market ETFs while in the typical market occasions, and their prices are according to the field. You can purchase shares away from ETFs, just like you can obtain offers of private stocks. However, since you’lso are to find section of a finance, you’ll provides dependent-inside the diversification. ETFs and you may mutual money are both choices of different assets, plus they is one another be definitely or passively addressed. Each other type of fund costs debts rates, however, ETF charge are lower.

Simple tips to trade equipment inside ETFs

You will want to very carefully opinion the brand new prospectus to possess an enthusiastic ETF’s debts ratio. Remember that, as with a number of other opportunities, you could remove particular or all of the dominant matter you are using. After you purchase an ETF, you’re joining other people inside the pooling your money to expend in the numerous securities at the same time. For each and every display you buy will provide you with a small little bit of the defense (asset) as part of the ETF. Because they’re built to mimic a list, passively addressed ETFs provide potentially down expenses and you can better tax efficiency.

They may be handled such as regular brings in this they can end up being sold and you will bought for a return, and so are exchanged to your an exchange on the change date. Although not, short-selling ETFs is actually a little much safer than just shorting individual holds since the of the lowest risk of an initial squeeze in the an enthusiastic ETF. That is a trading situation in which a secured item who may have already been heavily shorted spikes high, pressuring brief vendors for taking a loss of profits.